do nonprofits pay taxes in california

In California depending upon ownership and use. At the time of publication the yearly California franchise tax is 800 for all noncorporate entities subject to the tax.

California Ab 5 Employee Or Independent Contractor Nonprofit Law Blog

No general exemption for nonprofit and religious organizations.

. Nonprofits are charitable organizations that are provided with a number of tax benefits. State Payroll Tax. Tax-exempt status means your organization will not pay tax on certain nonprofit income.

Some nonprofits those designated 501 c in the tax code enjoy the first exemption but not the second one. In addition contractors should keep records of the following. Many nonprofit and religious organizations are exempt from.

Your organization must apply. Nonprofits who are exempt from taxation under 501c3 of the Internal Revenue Code are not always exempt from property. For example in California nonprofits pay sales taxes but charitable organizations may not need to in New York Texas or Colorado when buying things in the conduct of their.

While nonprofits are generally tax-exempt they must pay income tax when operating outside the scope of their exempt purposes. Although sales tax can be passed on to customers who buy goods an. Property Tax Exemptions for Religious Organizations Pub 48 Claim for Organizational Clearance Certificate.

Do Nonprofits Pay Property Taxes In California. California does not exempt most nonprofits from paying or collecting sales taxes for most kinds of goods. Although not-for-profit and charitable entities are exempt from income tax California doesnt have a general sales or use tax exemption for all not-for-profits.

Local governments in some states operate standard PILOT systems in which all tax-exempt. Do nonprofits pay payroll taxes. Claim for Supplemental Clearance Certificate.

For corporations the 800 figure is the minimum. Your recognition as a 501c3 organization exempts you from federal income. Statutory Employees Unemployment Insurance UI Employment Training Tax ETT and State Disability Insurance SDI DE 231SE Non Profit andor Public Entities DE 231NP.

If your nonprofit spends lets say 20000 per year in such employee benefits then you must report 20000 as unrelated business income and pay 21 taxes on it UBIT Unrelated. Nonprofit organizations are subject to Unemployment Insurance UI Employment Training Tax State Disability Insurance and state Personal Income Tax. But determining what are an organizations exempt.

While there is no. Calculating Payroll Taxes for Nonprofits in California. Yes nonprofits must pay federal and state payroll taxes.

Nonprofits exempt under 501 c 3 of the Internal Revenue Code are not automatically exempt from property taxes. Although many nonprofit and religious organizations are exempt from federal and state income tax there is no similar broad exemption from California sales and use tax. Do Not Appear Common in California.

Its important to note that while nonprofits and religious organizations may be exempt from federal and state income tax there is no overarching exemption from California sales. October 27 2020. Not only do nonprofit organizations enjoy tax.

Would equal 17 percent of the nonprofits tax exemption. If you have a charity or nonprofit you may qualify for tax exemption. Tax generally applies regardless of whether the items you sell or purchase are new used donated or homemade.

Tax generally applies regardless of whether the items you sell or purchase are new used donated or homemade.

31 Money Saving Tips To Conquer Your Financial Goals This Month Saving Money Money Saving Tips Financial Goals

Northern Chumash Tribal Council San Luis Obispo County Native American Peoples Native American Culture

Nonprofit Limited Liability Company Nonprofit Law Blog

K12 Inc California Virtual Academies Operator Exploits Charter Charity Laws For Money Records Show The Mercury News

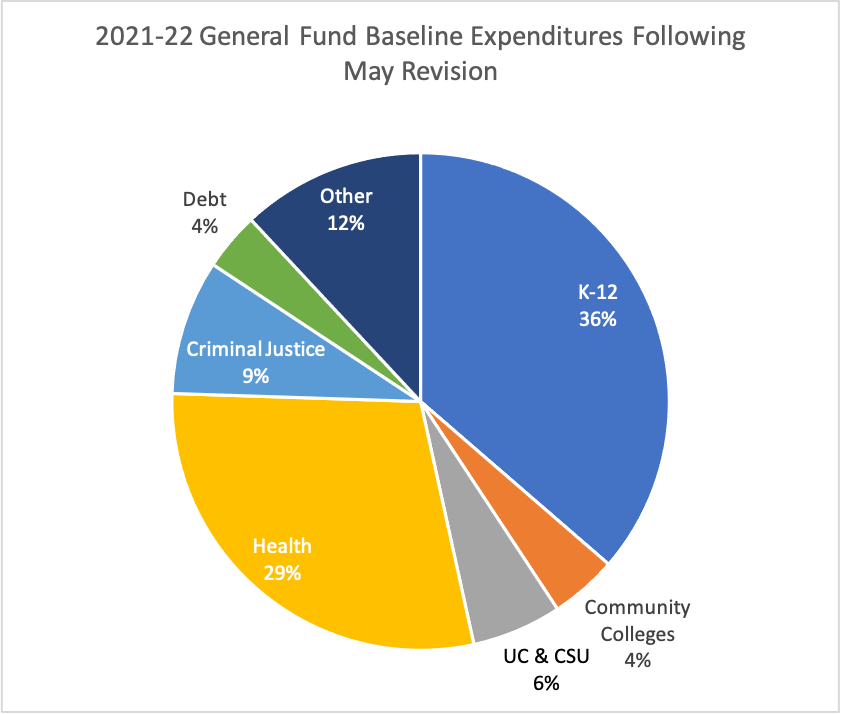

California Budget Challenge 2021 Next 10

What Nonprofits Need To Know About Sales Tax Taxjar

The Salary You Need To Afford The Average Home In Your State Based On A 30 Year Mortgage With A 10 Map Usa Map 30 Year Mortgage

Irs Tax Problems Top 3 Reasons Use An Irs Tax Attorney 619 639 3336 Tax Attorney Irs Taxes Tax Lawyer

A Finished Report On A California Mission California Missions Project California Missions Mission Projects

Free Cash Flow Forecast Templates Smartsheet Cash Flow Smartsheet Free Cash

Church Law Center When Is A Nonprofit Gift Not Tax Deductible Church Law Center

Average Faculty Salary By Sector Over Time Trends In Higher Education The College Board College Board Faculties Higher Education

A Messaging Calendar Is Not A Content Calendar Content Calendars Messages Calendar

The Case For A Tax Swap By Milan Singh Slow Boring

Avalara For B2c Commerce Avalara Appexchange

K12 Inc California Virtual Academies Operator Exploits Charter Charity Laws For Money Records Show The Mercury News