are campaign contributions tax deductible in 2019

Contributions or gifts to Candidate Committees are not deductible as charitable contributions for federal income tax purposes but Ohio taxpayers may claim a state tax credit for contributions made to. Can a deduction to a political campaign be deducted on the donors federal income tax return.

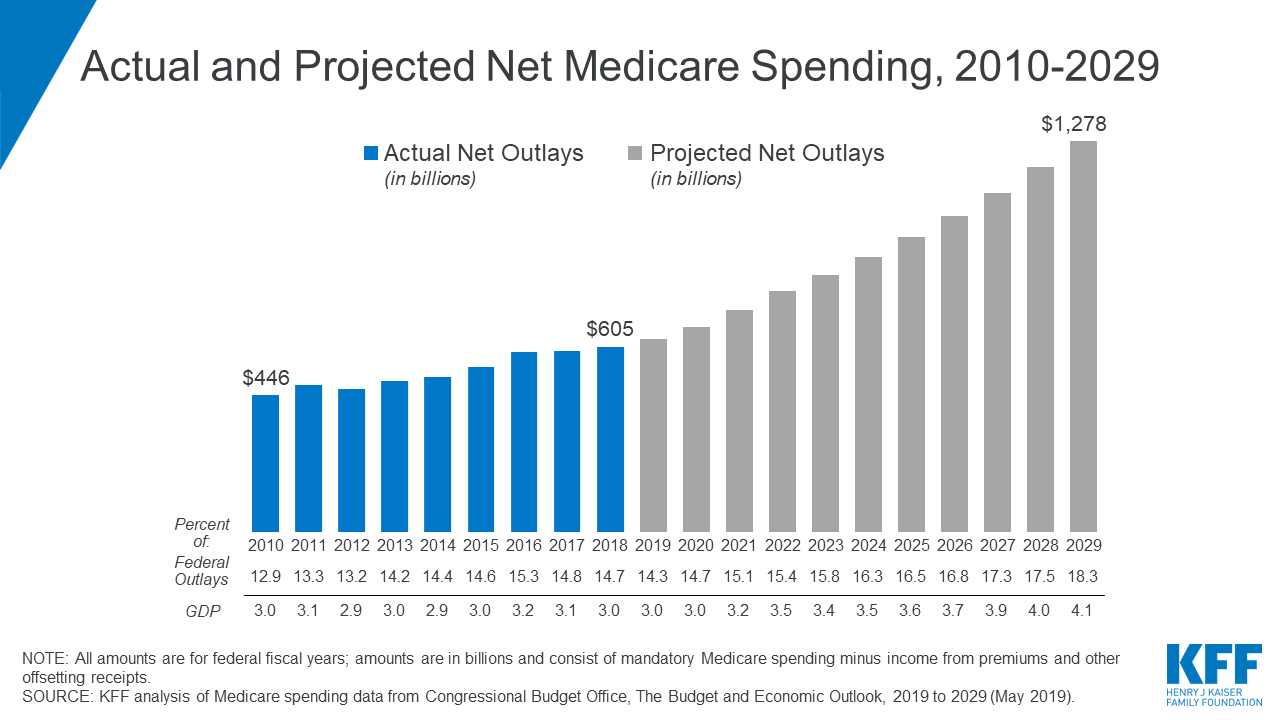

The Facts On Medicare Spending And Financing Kff

Whether you itemize or not the money you kick into a 401k is tax-deductibleas are contributions to a traditional individual retirement account IRA assuming you meet certain requirements.

. Are Campaign Contributions Tax Deductible. In addition to showing your support by voting in the 2016 election you may have also chosen to make a financial contribution to your candidate of choice during their campaign. The information in this article is up to date through tax year 2019 taxes filed in 2020.

TaxSlayer Editorial Team July 23 2019. How to get to the area to enter your donations. Special 300 Tax Deduction.

You cannot deduct expenses in support of any candidate. With the 2020 elections behind us and tax-filing season now here you might be wondering whether or not you can deduct political contributions you made last year. Start for 0 today Get your maximum refund with all the deductions and credits you.

For many people the tax break from Uncle Sam is almost as big a motivating factor as altruism. Political campaigns from national down to local rely on contributions to operate. Taxability of election contribution.

Some people express political Read more. But the federal tax code doesnt allow you to take a deduction for any political donations you make. Can I deduct my contributions to the Combined Federal Campaign CFC.

This Standard Deduction is a flat deduction the IRS offers to everyone. For 2022 contributions you must apply by April 15 2023. For 2019 each individual is allowed to take 12200 off of income while couples can take 24400 off.

Charitable contributions to qualified organizations may be deductible if you itemize deductions on Form 1040 Schedule A Itemized Deductions PDFTo see if the organization you have contributed to qualifies as a charitable organization for income tax deductions use Tax Exempt Organization Search. If you have access to an. 18920 5 Comments Closed.

Yes you can deduct them as a Charitable Donation if you file Schedule A. The following deductions are worth your attention when filing your 2019 tax returns. While inside the software and working on your return type charitable donation in the Search at the top of the screen you may see a magnifying glass there.

Individuals can give no more than 2800 to a given federal campaign during the 2020 election cycle. The answer is no. No political contributions are not tax-deductible.

Whether you actually end up getting a deduction depends mainly on whether or not you do what is called itemizing your deductions. Simply make a contribution by the end of the year and get it back on your tax return. This stems from the presumption that campaign contributions are meant to be utilized by the candidate for his or her campaign and not for personal use and are thus not a proper inclusion to the candidates taxable income.

Since primary and general elections count as separate cycles ardent supporters can give as much as 5600 to their preferred candidate. We all know that donations to charity are tax deductible. Likewise gifts and contributions to 501 c 4 social welfare organizations are not deductible as charitable contributions.

The answer is no political contributions are not tax deductible. For contributions made in 2021 complete 2021 Form PCR. Its only natural to wonder if donations to a political campaign are tax deductible too.

Are Political Contributions Tax. People everywhere from radio blurbs to posts on social media are. The Ohio Statehouse voted to remove this credit in 2019 then reinstated it at a later date.

As circularized in Revenue Memorandum Circular RMC 38-2018 and as reiterated in RMC 31-2019 campaign contributions are not included in the taxable income of the candidate to whom they were given the reason being that such contributions were given not for the personal expenditure or enrichment of the concerned candidate but for the purpose of utilizing such. Unutilizedexcess campaign funds that is campaign contributions net of the candidates campaign expenditures will be considered subject to income tax and as such must be included in the candidates taxable income as stated in his or her income tax return filed for the subject taxable year. For 2021 contributions you must apply by April 18 2022.

Generally a taxpayer is allowed a deduction for any charitable contribution that is made during the tax year. Political donations to federal candidates and committees are not deductible from federal income taxes whether they are made online or in person. It has been updated for the 2019 tax year.

The May 2019 elections are fast approaching. Otherwise the donations are not exempt from donors tax and not deductible as a political contribution on the part of the donor. The potential for matching donations is restricted by campaign contribution limits.

Though giving money to your candidate of choice is a great way to get involved in civic discourse political donations are not tax deductible. So you might feel that you deserve a tax break when you support the democratic process by making a campaign contribution. The refund is the amount of your contributions up to 50 for individuals or 100 for married couples if you file a joint Political Contribution Refund application.

However donations to ActBlue Charities and other registered 501 c 3 organizations are tax deductible.

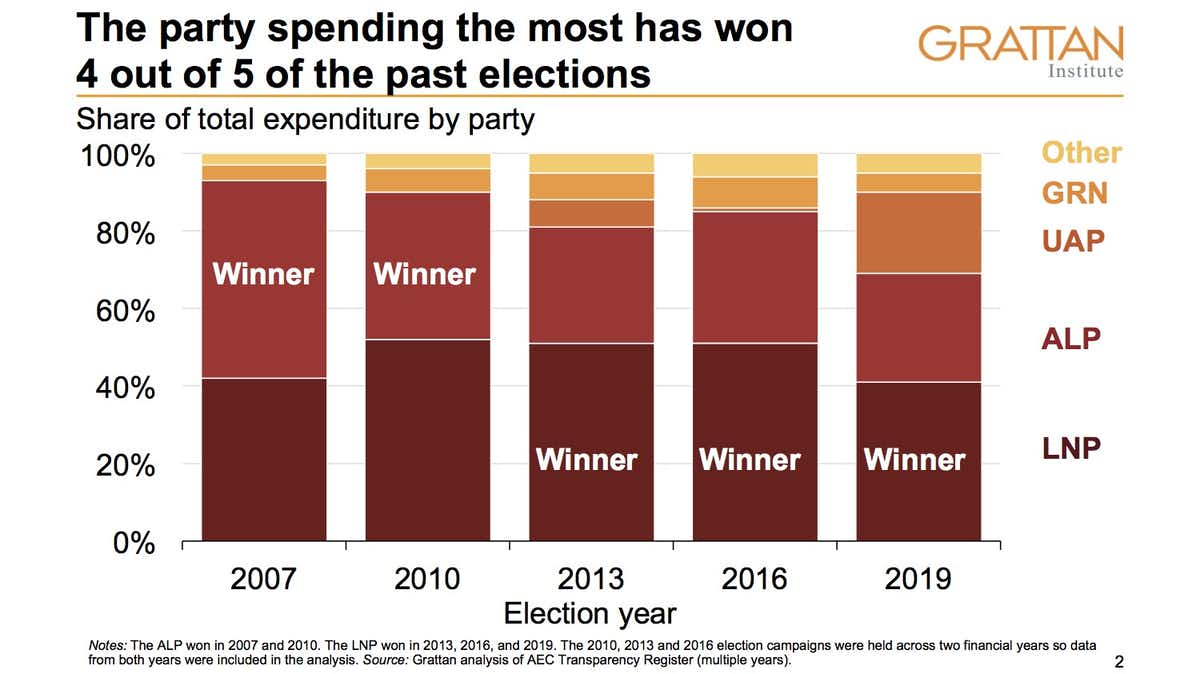

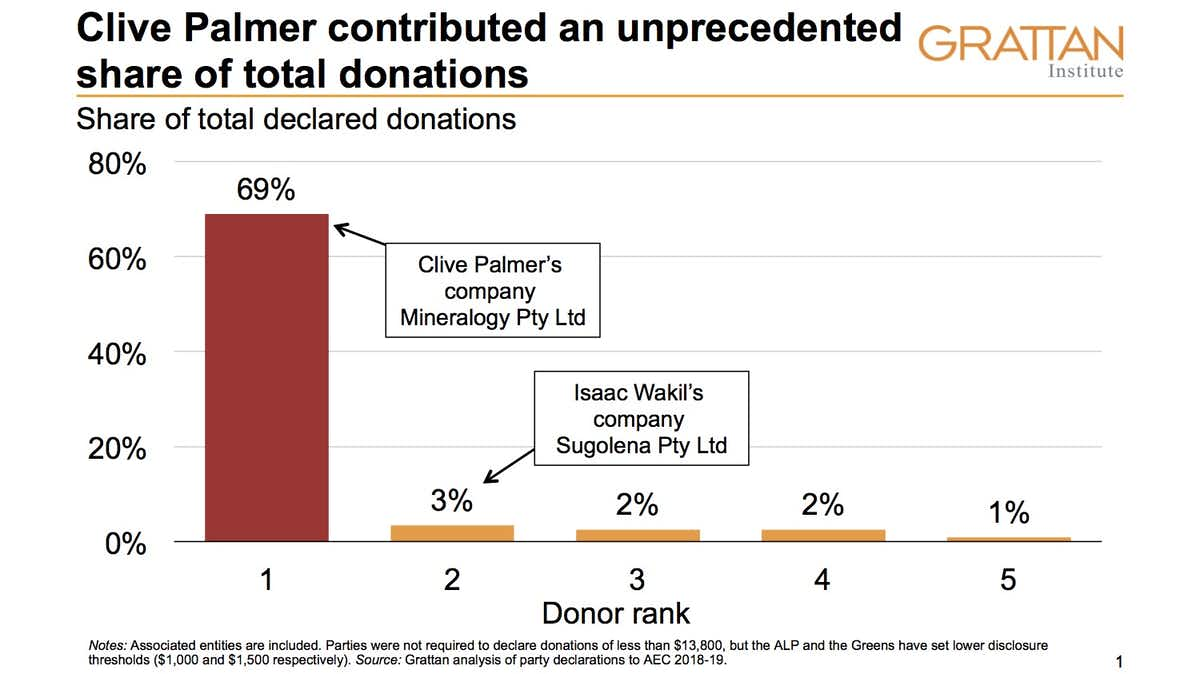

How Big Money Influenced The 2019 Federal Election Grattan Institute

The Subsequent Huge Factor The Age Of Fintech Ai And Huge Knowledge In 2022 Fintech Knowledge Age

Seychelles Request For An Extended Arrangement Under The Extended Fund Facility Press Release Staff Report And Statement By The Executive Director For Seychelles In Imf Staff Country Reports Volume 2021 Issue 184 2021

Pin On Examples Online Form Templates

Pin By Anis Manchester On Good Smoke Bomb Photography Inheritance Europe

We Thank Each And Every One Of You Who Have Been A Part Of Our Contribution And Has Helped Make This Campaign A Success T You Better Work No Response Thankful

Seychelles Request For An Extended Arrangement Under The Extended Fund Facility Press Release Staff Report And Statement By The Executive Director For Seychelles In Imf Staff Country Reports Volume 2021 Issue 184 2021

Green Card Lottery To Usa Green Cards Social Media Template Lottery

Petition We Want Environmental Law Classes In 2021 Environmental Law Environmental Justice Finance Investing

Fundraising Planning Guide Calendar Worksheet Template Marketing Plan Template Fundraising Marketing Nonprofit Fundraising

How Big Money Influenced The 2019 Federal Election Grattan Institute

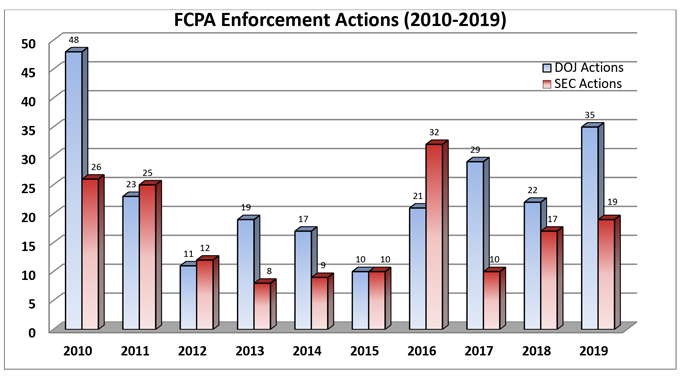

2019 Year End Fcpa Update Gibson Dunn

Progressive Change Campaign Committee Boldprogressives Org Shirts Black Shirt Black Tee

Pin By Niina Felushko On Financial Matters Senior Discounts Efile Tax Return

Seychelles Request For An Extended Arrangement Under The Extended Fund Facility Press Release Staff Report And Statement By The Executive Director For Seychelles In Imf Staff Country Reports Volume 2021 Issue 184 2021

Improve Your Accounting By Using Sku Numbers Small Business Trends Business Trends Small Business Trends Business Strategy